rank real estate asset classes by risk

Risks and rewards of. Site visit of the market and city.

Real Estate Private Equity Career Guide

Ad We vet thousands of real estate projects across the country bringing you the very best.

. The asset classes types include fixed income cash cash equivalents equity and real estate. Meanwhile a majority of those who retire in their 50s and 60s expect to live much longer than 20 years and thus most consider inflation risks as much of a threat as stock market risk. Standard Deviation of Ranks.

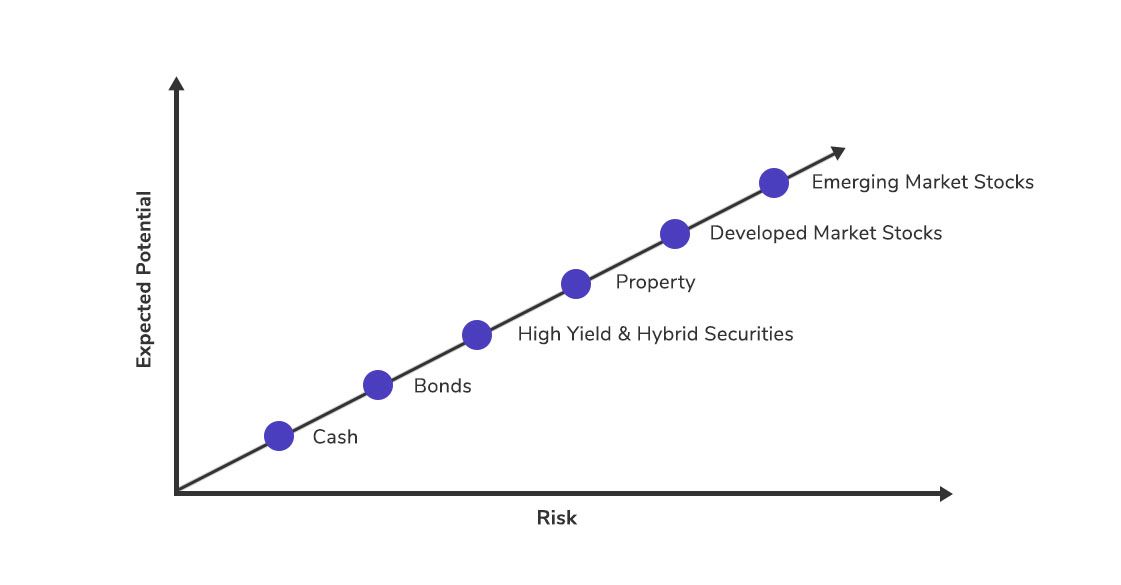

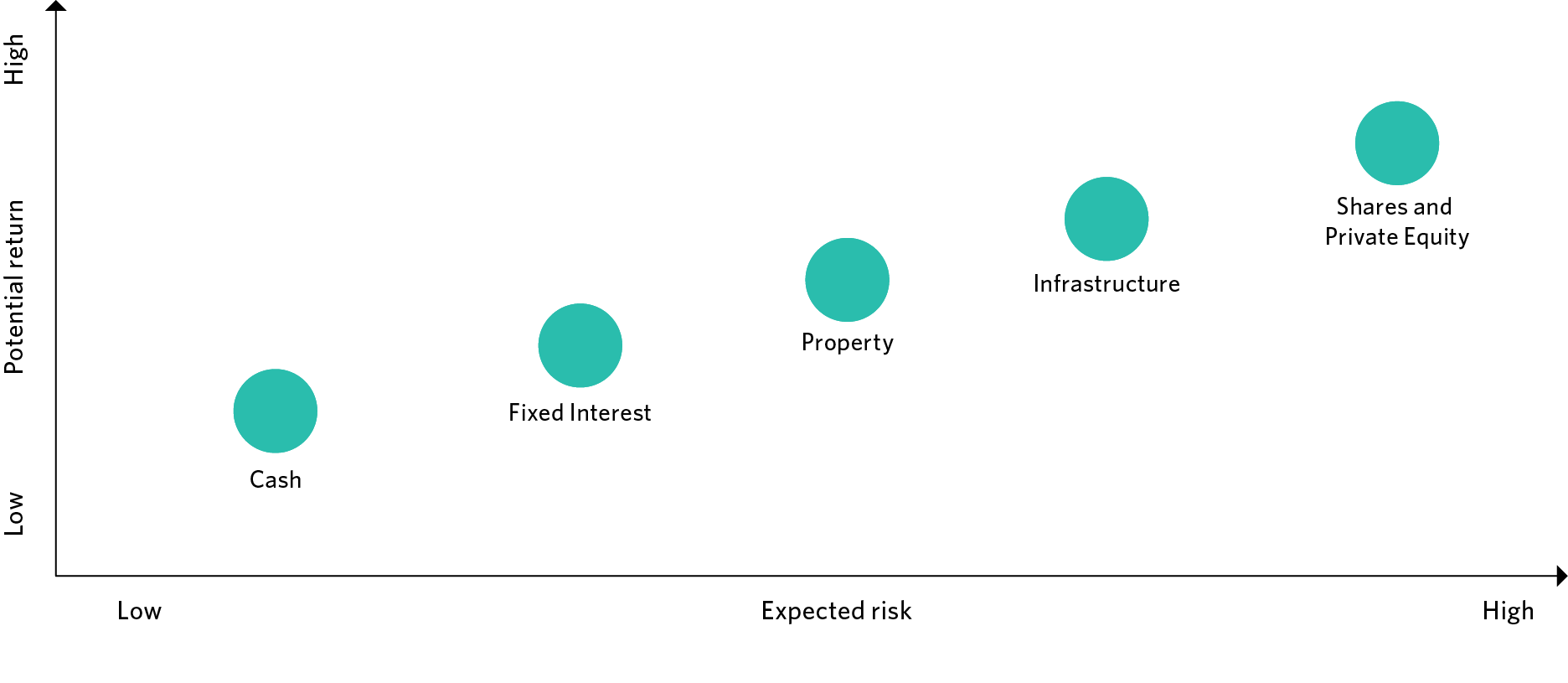

For each of the 12 asset classes well be working with the annual returns from 1985 to 2020 a total period of 36 years. Real Estate Risk Spectrum. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations.

Note that while there exists a general consensus on the. The first asset class is real estate. Ranking the real estate asset classes in terms of risk Dear all.

Investing With DiversyFund Is Open To The Everyday Investor. Property class A. Heres how total returns stack up by property sector sorted from highest to lowest return in 2021.

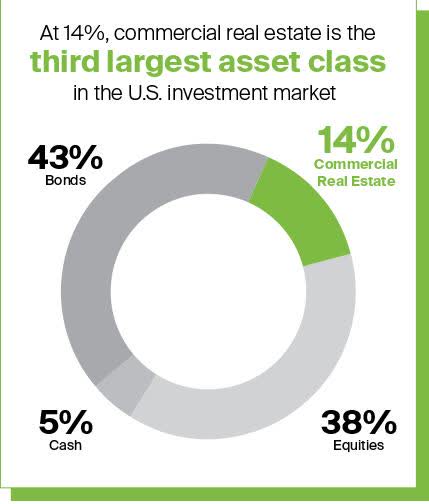

First the return correlations of commercial real estate compared to other asset classes has historically been low. -Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking. Specialty and data center sectors are excluded as this data was only available from 2015 onwards.

A class A building is generally newerprobably less. Ad Invest In Commercial Real Estate Long Term To Keep Your Assets Stable During Volatility. Site visit of the property.

Get Started With Just 500. Risk and return drivers for real estate include. Comparable property sales on a per square foot basis.

13 Last Rank of Time In Top Half of Ranks Ranks 1-6 Emerging Market Stocks. Your due diligence and real estate risk analysis should include the following. These issues include.

Evaluate credit risk juggle different pass-through reimbursement structures and general asset marketingpresentation that I would argue are more sophisticated than other asset classes. Data for 2021 is as of November 30. Equities stocks and fixed income bonds are traditional asset class examples.

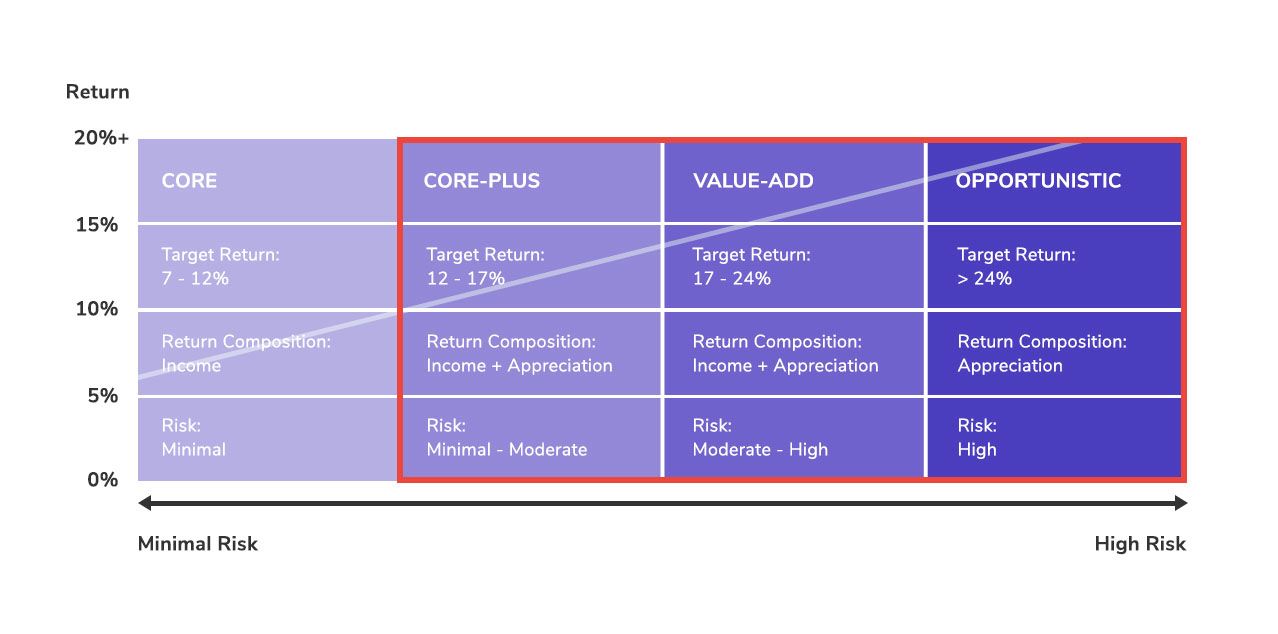

The risk-adjusted performance of core and non-core funds principalagent issues in incentive fees a comparison of REITs and private real estate real estates pricing and return-generating process real estates role in a mixed-asset portfolio the strategic uses of leverage etc. Tenants earn high incomes and properties have are rarely vacant. Note that all returns in this analysis are the real total return values meaning that they are adjusted to take into account inflation and the re-investment of dividends.

One example would be Real Estate Investment Trusts REITs. I personally transitioned from office to multifamily and find multifamily much easier to. Economic analysis of the region through job statistics major employers affordability and market forecasts.

Here are the types of asset classes ranging from high risk with high return to low risk with low return. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. Commercial real estate offers two ways to diversify your investment portfolio.

Some risks are shared by every investment in an asset class. This is truly the best location you can find and the highest-quality tenants want to rent here. It aids the investors in deciding the proper investment strategies and receiving maximum profits with minimal risk prospects.

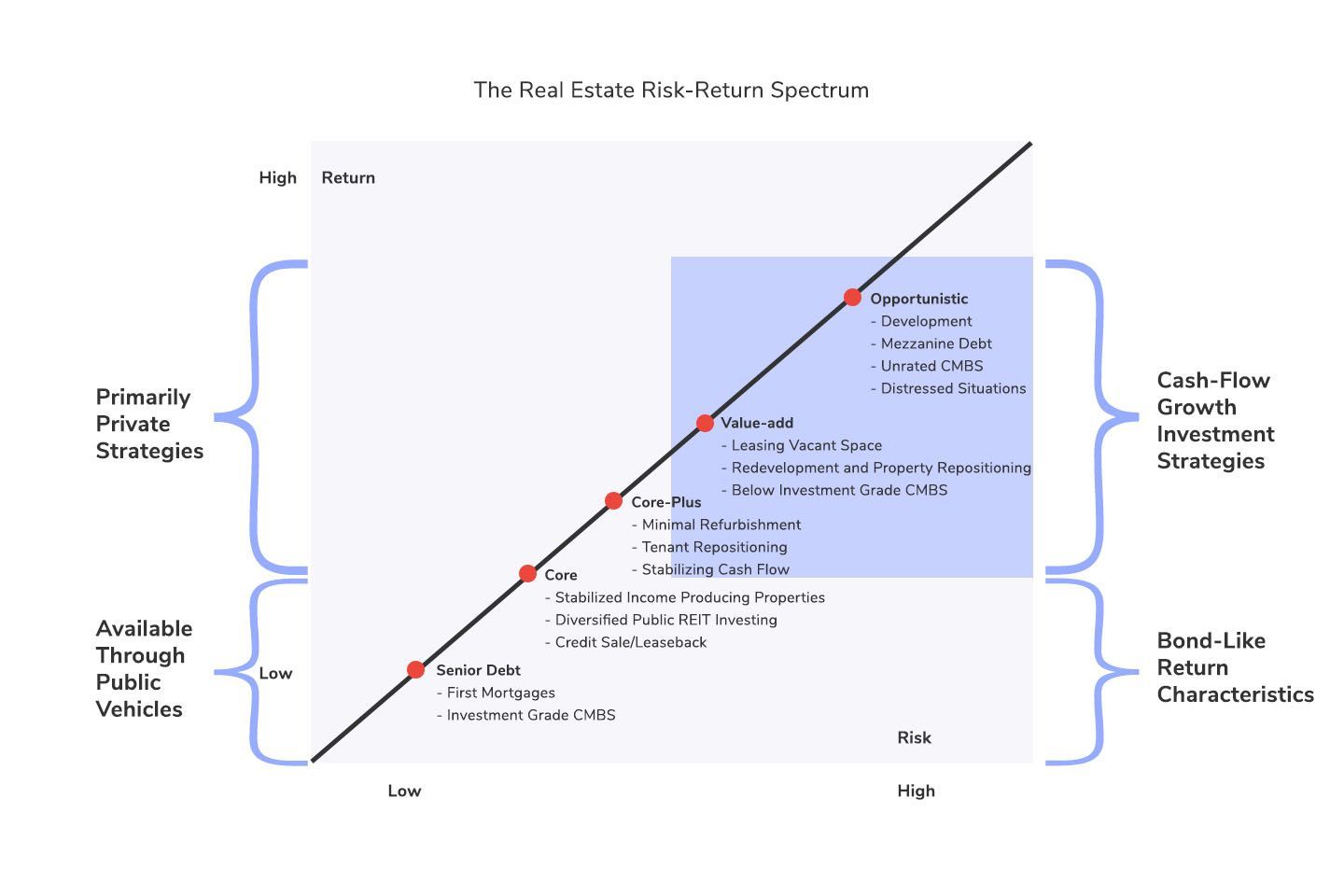

Broadly these strategies fall into four categories Core Core-Plus Value-add and Opportunistic. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations. Diversify across markets property types and riskreturn profiles.

A drop in the stock market does not necessarily correlate to a fall in real estate. Ranking the real estate asset classes in terms of risk. Real estate has the highest risk and the highest potential return.

A real estate investment trust is a company that owns operates or finances income-producing real estate. Im mainly looking at. A class A location is an area with new buildings hot restaurants great schools and expensive real estate.

Real estate as represented by the National Association of Real Estate Investment Trusts Index has been the best-performing asset class over the past 20. There are significant differences between stocks and bonds different asset classes such as risk how they are traded how they pay. 13 Last Rank of Time In Top Half of Ranks Ranks 1-6 Emerging Market Stocks.

The real estate investment industry had established a set of common terminology for classifying investment strategies and their typical risk-return profile. Asset classes refer to a group of securities with comparable features and responses to market variations. Oct 21 2016 235 PM EDT.

Commercial real estate is a longer-term investment.

3 Best Reits To Fight Inflation In 2022 Seeking Alpha

Know Your Real Estate Risk Reward Spectrum Before Investing

Recommended Net Worth Allocation By Age And Work Experience

Recommended Net Worth Allocation By Age And Work Experience

2021 Global Real Assets Outlook Institutional Blackrock

Asset Classes Explained Understanding Investments Unisuper

Know Your Real Estate Risk Reward Spectrum Before Investing

/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

Know Your Real Estate Risk Reward Spectrum Before Investing

All About Asset Classes And Investment Diversification The Motley Fool

Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments

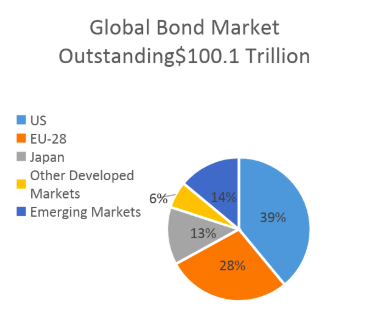

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Private Real Estate Debt The Pandemic S Impact And The Industry S Future

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments

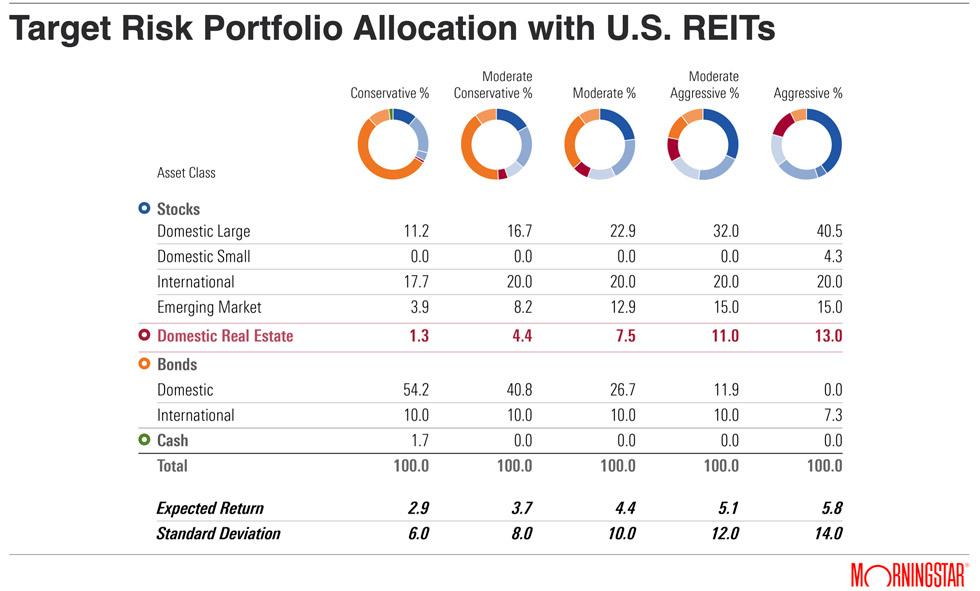

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)